Everything You Need to Know About Investment Properties in Coastal Areas

Coastal real estate investment is a venture that combines the charm of scenic locations with the promise of high returns. Whether you’re looking for a beach house vacation rental, a second home, or a long-term investment, coastal properties can provide unique benefits and opportunities.

However, they also come with their own set of challenges. This guide will cover everything you need to know about investing in coastal properties, with a focus on popular areas like Charleston, SC, and its surroundings.

Why Invest in Coastal Properties?

Coastal real estate has always been a popular choice for investors, and for good reason. Here are some of the top reasons why investing in coastal properties can be a lucrative decision:

1. High Demand for Vacation Rentals

Coastal areas, particularly those with beautiful beaches, warm climates, and vibrant tourist attractions, attract millions of visitors each year. For instance, Charleston saw over 7.9 million tourists in 2023, generating significant demand for beach house rentals throughout the year. Properties in these areas can yield impressive returns, especially during peak seasons like summer and holidays. Locations like Folly Beach or Isle of Palms, known for their beachfront properties and serene environment, can command higher nightly rates, making them a strong option for short-term rental income.

2. Property Appreciation

Desirable coastal locations often experience significant property value appreciation. For example, coastal cities in South Carolina have seen steady growth in real estate prices over the last decade, driven by factors such as increasing demand for vacation homes, limited supply, and the appeal of waterfront views. Investing in these regions can lead to a profitable long-term investment, with properties gaining value faster than those in less desirable inland locations. This appreciation is particularly noticeable in areas with strong demand and natural beauty, like Charleston.

3. Lifestyle Benefits

Owning a coastal property can be more than just a financial investment. Many buyers purchase properties they can also use for vacations or as a future primary residence, making it a versatile asset. The ability to enjoy an oceanfront property while also renting it out when not in use is a benefit that attracts many investors. In Charleston, for example, owning a property near the water means access to boating, fishing, and other outdoor activities that enhance the overall lifestyle appeal.

Key Considerations Before Investing

While there are many benefits, investing in coastal properties requires careful planning and consideration. Here are some critical factors to keep in mind:

1. Seasonal Market Trends

Understanding the local market conditions is crucial. Coastal properties may have peak seasons where demand and rental income are high, but there can also be off-seasons with lower occupancy rates. For instance, properties in Charleston might see a surge in bookings from spring through late fall, with a dip during the winter months. Investors should plan for these seasonal demand fluctuations, ensuring they have strategies to attract visitors even during the off-peak season, such as offering special rates or promoting the property for events and holidays.

2. Local Regulations and Zoning Laws

Each coastal region has its own zoning regulations regarding property use, zoning restrictions, and short-term rentals. For example, Charleston has specific permits and regulations for vacation rentals, particularly in historic districts. It’s essential to understand these laws to avoid fines and legal issues. Consulting with local experts, such as The Family Real Estate Group, can help you navigate these rules and ensure compliance.

3. Insurance Requirements and Environmental Concerns

Coastal properties often face unique risks, such as hurricanes, storm surges, and flooding. As a result, insurance premiums can be higher, and it’s crucial to factor these into your investment calculations. In regions like Charleston, obtaining flood insurance is mandatory, especially for properties in a flood plain.

Additionally, investors should consider environmental risks, such as proximity to the water, elevation, and the property’s resilience to natural hazards. Investing in flood-resistant properties with solid construction, elevated designs, and hurricane-resistant features can mitigate some of these risks.

4. Maintenance and Upkeep

Coastal properties tend to require more maintenance than traditional properties. Saltwater, humidity, and weather-related risks can lead to faster wear and tear on buildings, requiring regular upkeep to maintain the property's appeal and functionality. Investors should plan for these maintenance costs, which include regular exterior painting, roof maintenance, and pest control, among others.

Managing Investment Risks

Investing in coastal properties isn’t without its challenges, but with the right strategies, you can mitigate many of these risks. Here are some essential tips:

1. Effective Property Management

Property management is critical, especially for investors who do not live near their property. Hiring a local property manager can ensure that your property is maintained, cleaned, and rented efficiently. This is particularly important in coastal regions where the property may be rented to short-term guests frequently. Companies like The Family Real Estate Group offer comprehensive property management services that can handle everything from marketing to maintenance, providing peace of mind for remote investors.

2. Natural Disaster Preparedness

Coastal regions are more prone to hurricanes, tropical storms, and other severe weather. To protect your investment, ensure your property is equipped with proper safeguards such as storm shutters, elevated structures, and robust drainage systems. Having a solid insurance policy that covers natural hazards is also essential. Make sure to work with insurers who specialize in coastal properties to get the best coverage possible, including protection against the risk of water damage.

3. Market Volatility and Economic Factors

Real estate markets can fluctuate, and coastal areas can be particularly sensitive to changes in tourism, local economic growth, and broader real estate market shifts. It’s vital to keep an eye on these factors to make informed decisions. For example, monitoring developments in local infrastructure, new attractions, or changes in travel patterns can provide insights into potential shifts in property demand.

Top Coastal Areas to Consider in South Carolina

Charleston and its surrounding areas have become increasingly popular for real estate investors. Here are some key coastal locations to consider:

1. Charleston

Known for its historic charm, vibrant culture, and beautiful coastline, Charleston is a prime location for investors. The city sees a steady influx of tourists year-round, offering excellent rental returns. Properties in Charleston’s historic districts or near popular beach towns can yield higher returns, thanks to the area’s established tourism industry and appealing lifestyle.

2. Goose Creek

Just a short drive from Charleston, Goose Creek, SC provides a more affordable entry point into coastal real estate. It’s ideal for investors looking to capitalize on the proximity to major attractions while avoiding higher property prices. Goose Creek has seen steady development, making it an up-and-coming spot for those looking to invest in properties that can appreciate quickly.

3. Folly Beach, Isle of Palms, and Sullivan's Island

pictured: Folly Beach, SC

pictured: Folly Beach, SC

Pictured: Isle of Palms, SC

Pictured: Isle of Palms, SC

pictured: Sullivans Island, SC

pictured: Sullivans Island, SC

These areas are well-known for vacation rentals. While the purchase price may be higher, so is the potential for income, especially during peak tourist seasons. Folly Beach offers a more laid-back atmosphere, attracting tourists looking for a relaxed beach vacation. Isle of Palms and Sullivan's Island, on the other hand, appeal to luxury tourists, making them excellent choices for high-income property owners seeking solid returns.

Financial Insights

Understanding the financial aspects of investing in coastal real estate is critical. Here are some key points to consider:

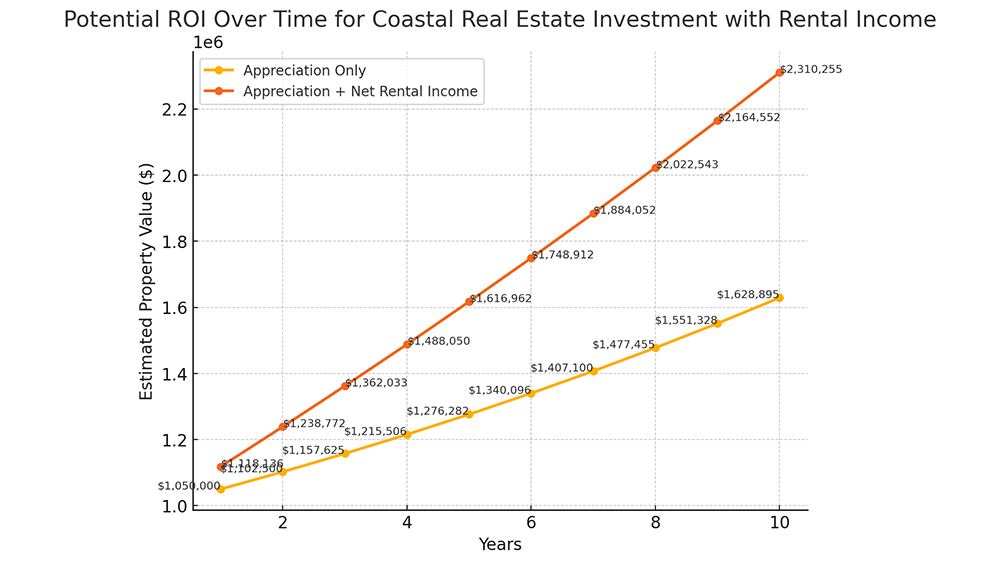

1. Cost Estimation and ROI

Calculate all potential expenses, including mortgage payments, insurance, property taxes, maintenance, and property management fees, to ensure you can achieve a reliable income stream. Tools like ROI calculators or consulting with a local real estate expert can help. Remember to account for seasonal variations in rental income and plan your finances accordingly.

2. Tax Benefits and Deductions

Coastal property investors can take advantage of several tax incentives, including deductions on mortgage interest, property management fees, and depreciation. For instance, vacation rental properties may qualify for tax deductions on furnishings, maintenance, and even travel expenses if you visit the property for upkeep. Consulting with a tax professional can help you navigate these benefits and ensure you’re maximizing your financial returns.

3. Financing Options for Coastal Investments

Securing financing for coastal properties may come with its own challenges, but there are specific loans designed for vacation rentals and investment properties. Make sure to explore options like private lenders, VA loans, or money lenders specializing in investment opportunities. Some lenders also offer vacation rental-specific mortgages, which consider the potential rental income as part of the borrower’s income, making it easier to qualify.

Conclusion

Investing in coastal properties can be an exciting and profitable venture, but it requires careful planning and knowledge of the local market. From understanding seasonal trends to managing risks and exploring financial options, a well-researched investment can lead to significant returns. Coastal areas like Charleston, Goose Creek, and Folly Beach offer unique opportunities for those looking to enter this market.

Ready to invest in coastal real estate? Contact The Family Real Estate Group today!

Our experienced team can guide you through the process, help you find the perfect property (whether it's better to buy or build a home), and provide expert advice on making the most of your investment. Whether you’re a first-time investor or a seasoned pro, we’re here to make your coastal property investment a success.

Categories

Recent Posts